- 02 Jun 2023

- 17 Minutes To Read

- Print

- DarkLight

- PDF

Setting Up New Deposit Products

- Updated On 02 Jun 2023

- 17 Minutes To Read

- Print

- DarkLight

- PDF

A deposit product allows you to set up in advance the parameters for a type of deposit that you wish to regularly offer. Deposit products are flexible and highly-customizable templates for creating individual deposit accounts.

Creating deposit products allows you to categorize, advertize, sort, and compare deposit types using easy-to-recognize names that your customers can quickly understand. For example, you may wish to offer a Junior Deposit that features a particular interest rate and uses a particular pattern to generate IDs. To do so, you may create a corresponding deposit product and set your desired terms. This makes it quick and easy to create the actual individual deposit accounts.

You can also compare the different products' performance and identify the most successful products as well as those that need to be modified to achieve your goals.

For more information, see Managing Deposit Products and Linking Products to Accounting.

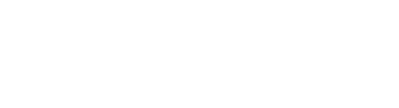

Deposit products vs. Deposit accounts

All deposit accounts are associated with deposit products. For that reason, the terms and constraints you define when creating a deposit product will apply to all of the deposit accounts created using that product. However, some attributes can be changed when creating a new account from a product. These include fields like Maximum Withdrawal and Minimum Deposit amounts, Overdraft Limits and Overdraft Terms, depending on the type of deposit product being used to create a deposit account.

Creating a new deposit product

To create a new product:

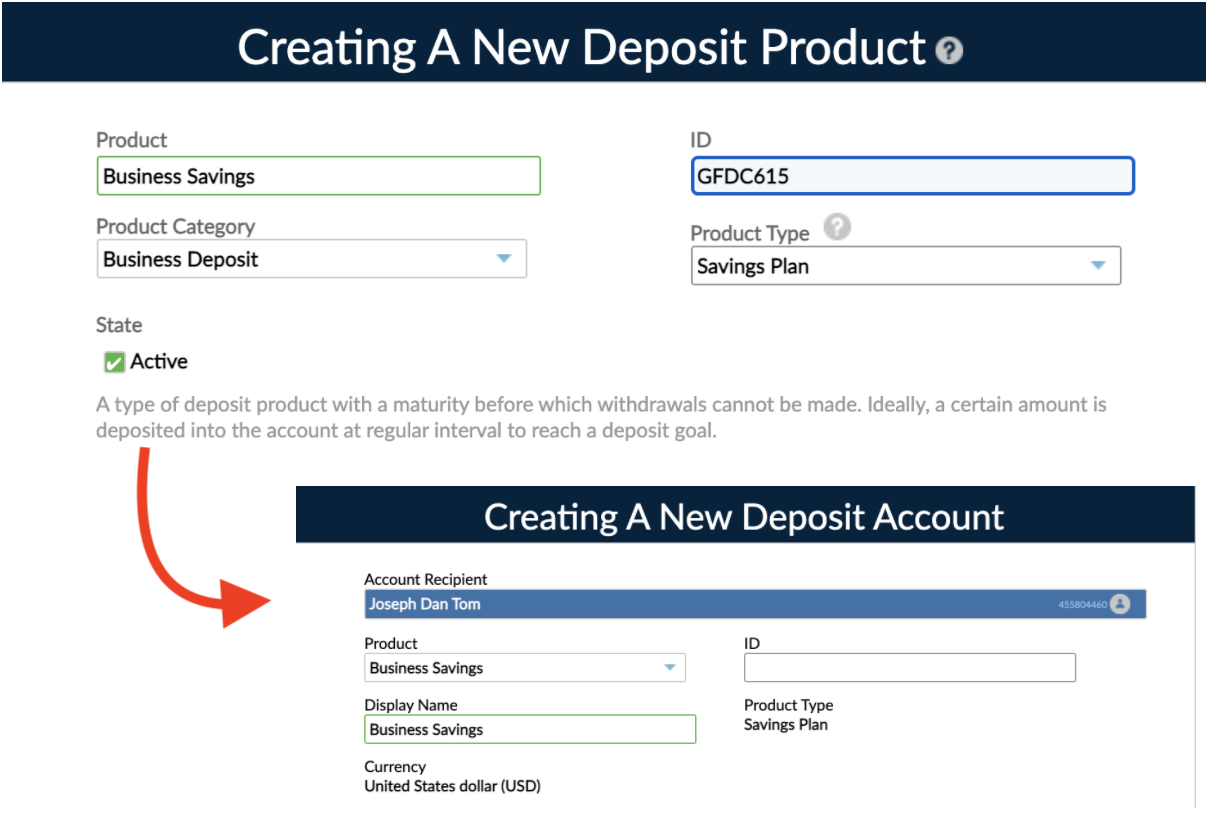

- On the main menu, go to Administration > Products > Deposits.

- In the bottom-right corner, select New Deposit Product.

- Enter all the required information. (We will cover all the configuration options in depth.)

- Select Save Product.

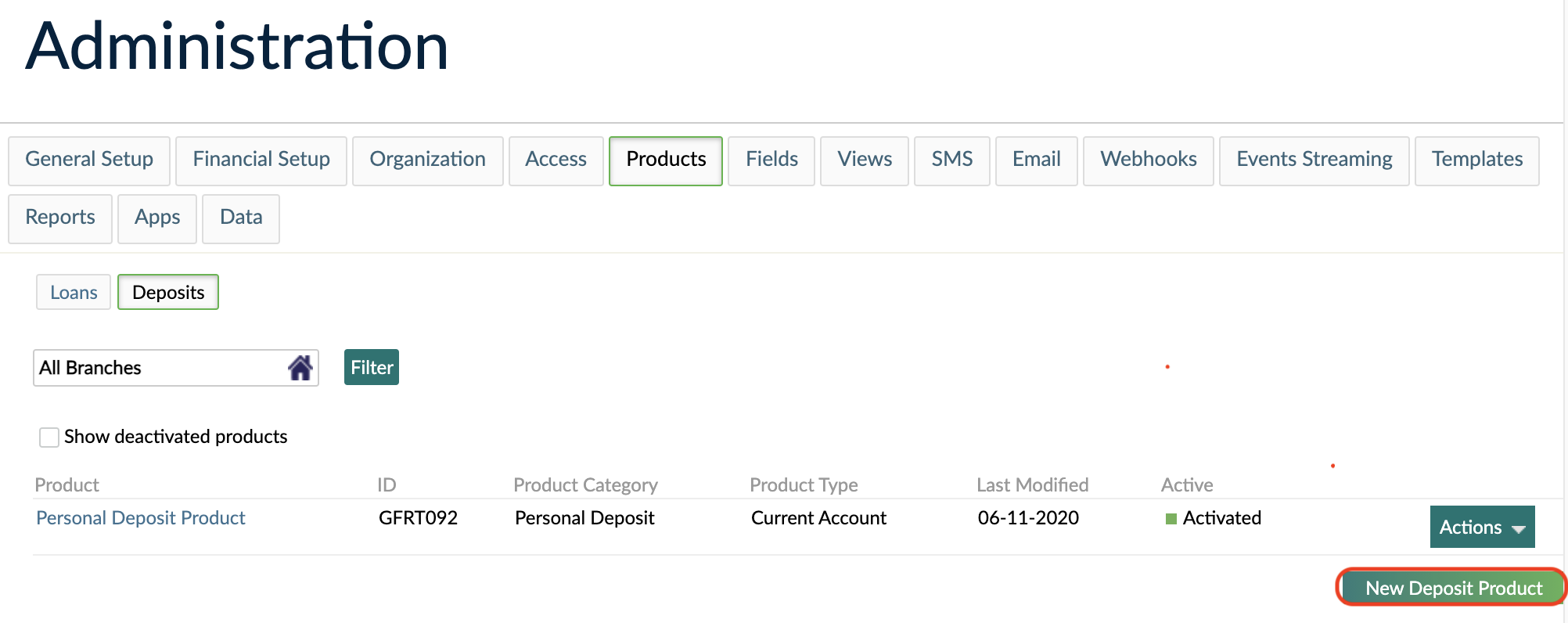

After saving the product you can click on Show deactivated products to view all activated and deactivated products. You can later activate a product from the Actions dropdown list.

Filling out the form

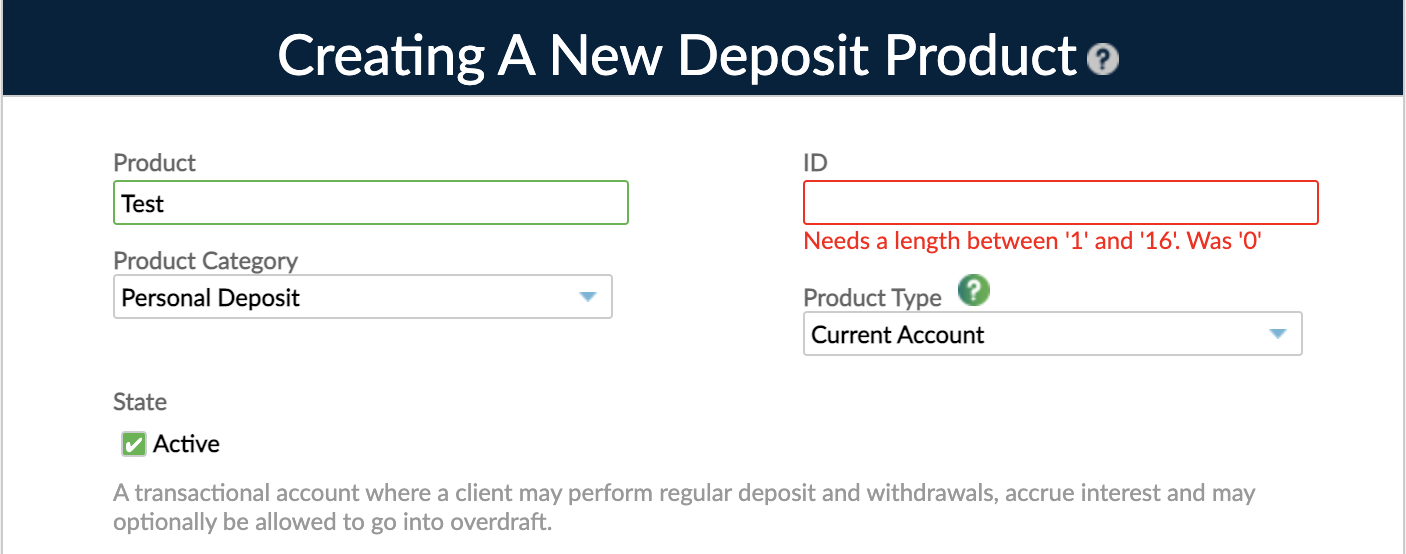

Product name

Enter a relevant product name. The new product name should be easily recognizable or associated with the deposit's purpose so that staff members or other users dealing with products can easily identify it.

Product ID

The product ID is a mandatory and unique alphanumeric code you give your products, allowing them to be identified in the database. Enter an ID between 1 and 16 characters.

Product category vs product type

The product category helps us better understand how your product is used so we can provide better service and address the specific needs of your use cases, whereas the product type determines the set of features available in the configuration.

To understand which category goes with which type, please see the following table:

| Product Groups | Product Categories | Product Types | |||

| Current account | Savings account | Savings plan | Fixed deposit | ||

| Stored Value Accounts | Stored Value Accounts | Yes | No | No | No |

| Consumer Deposits | Daily Banking | Yes | No | No | No |

| Personal Deposits | No | Yes | Yes | Yes | |

| Business Deposits | Business Banking | Yes | No | No | No |

| Business Deposits | No | Yes | Yes | Yes | |

The Funding account product type is used to enable the funding of peer-to-peer (P2P) lending which we don't support anymore.

If you select the Uncategorized product category, you can select any product type.

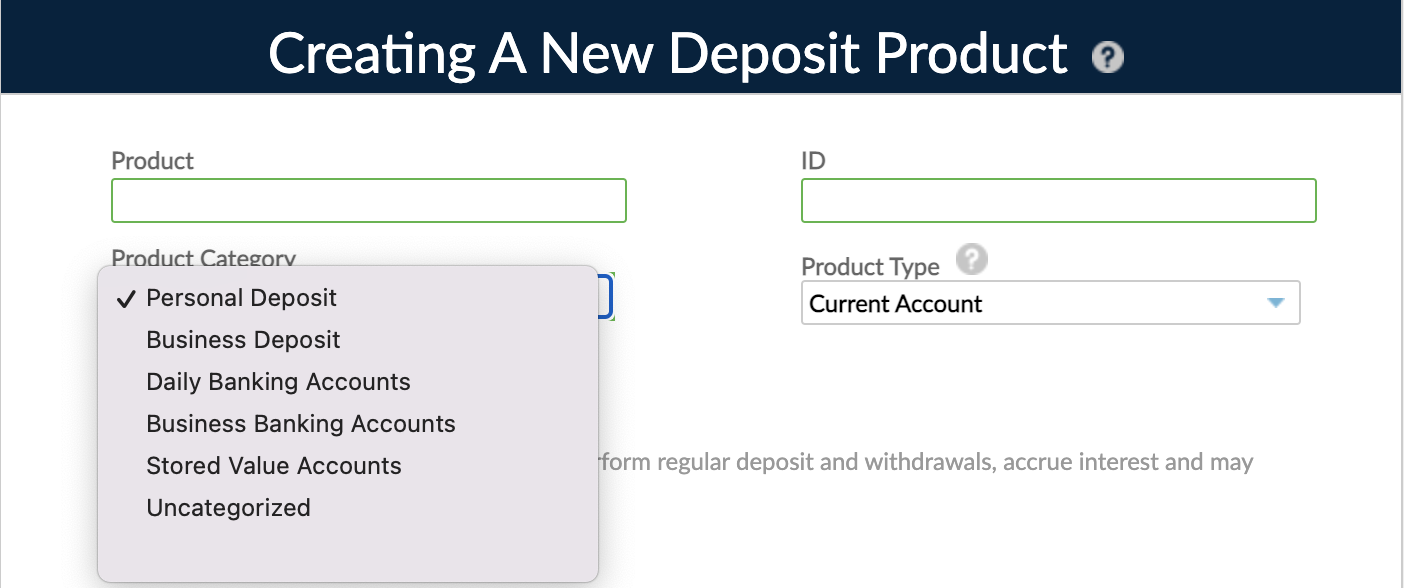

Deposit product categories

You must assign categories to all of your products. If your product falls under no specific category, select Uncategorized.

To set the product category for a deposit product, choose from:

- Stored Value Accounts: Transactional accounts which support digital wallets, prepaid or stored value cards.

- Daily Banking Accounts: Transactional accounts with typical banking capabilities, such as debit or credit cards, for personal use.

- Personal Deposit: Savings accounts, term deposits, and similar products for individuals.

- Business Banking Accounts: Transactional accounts with typical banking capabilities, such as debit or credit cards, for business use.

- Business Deposit: Savings accounts, term deposits, and similar products for businesses.

- Uncategorized: Accounts that fall under no specific category, such as settlement accounts for loans, nostro, and technical accounts. If you select Uncategorized, we recommend you to fill in the product description and add the use case of the product.

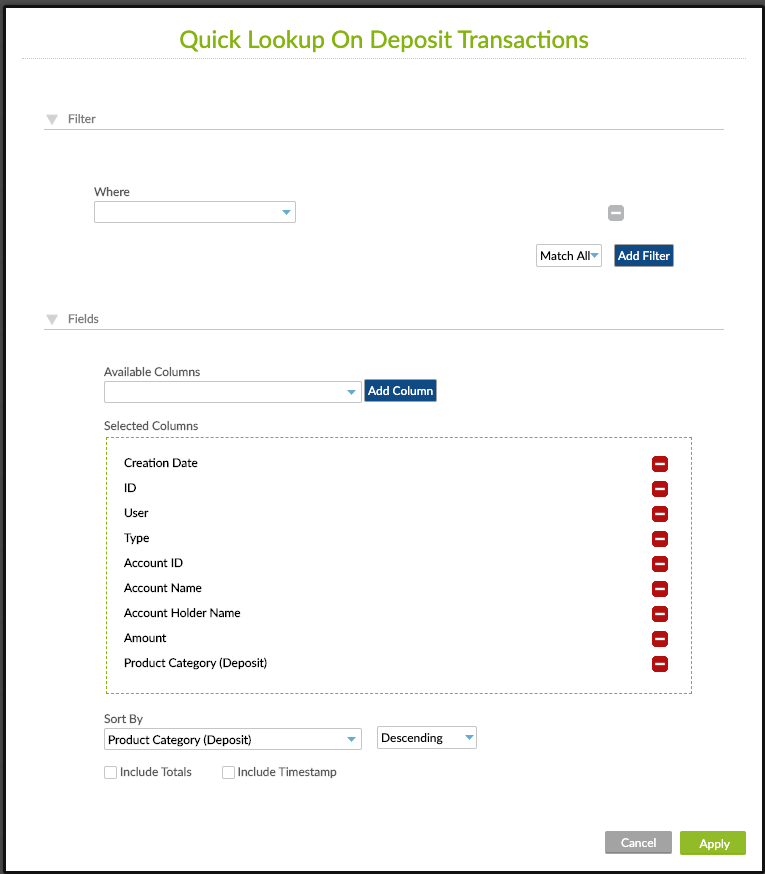

Product category is included as a column in all product views, and can be used as a column and sorting filter in Custom Views.

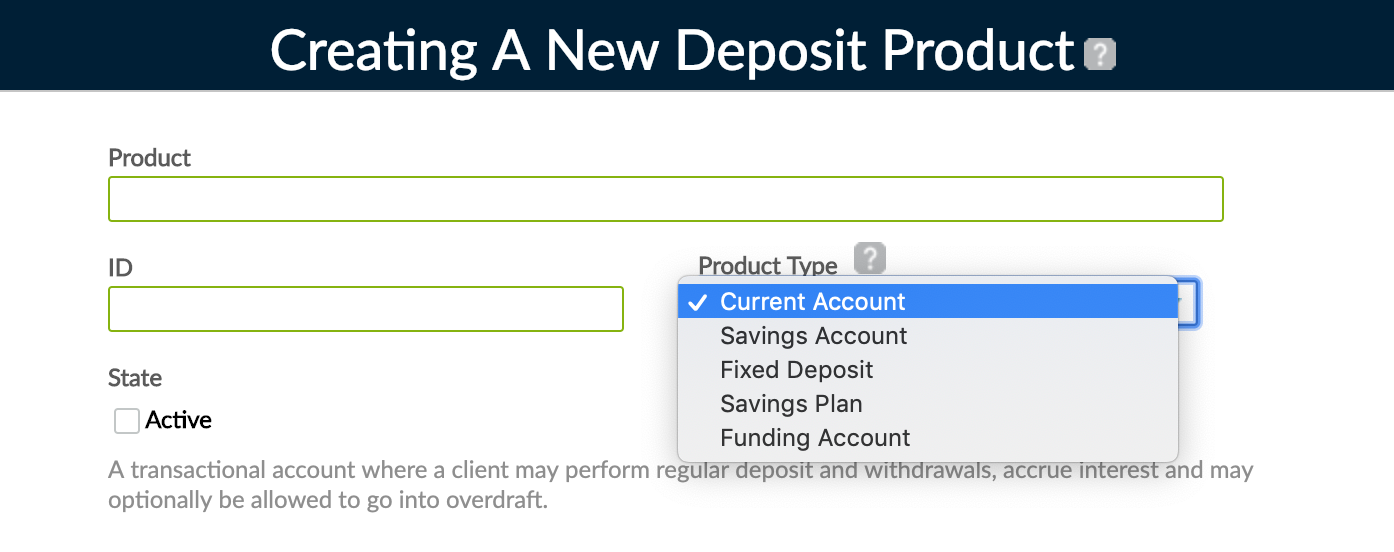

Deposit product types

Mambu supports five types of deposit products:

- Current Account: A regular savings product, but that allows for Overdrafts. Choosing this option will allow account balances to go negative up to a certain defined limit.

- Savings Account: Allows you to create accounts where clients can make deposits and withdrawals when they wish. The interest is posted at the frequency you choose and accrued over time. It doesn't allow overdrafts.

- Fixed Deposit: As the name suggests, fixed deposits have a fixed term after which they should be withdrawn or closed. With this type of product, clients are able to make deposits until the minimum opening balance has been reached. At this point, you can begin the maturity period, during which they will be unable to deposit, but will be able to withdraw. Before the maturity date, you have the option to undo maturity.

- Savings Plan: Uses a maturity period like fixed deposits, but once the minimum opening balance has been reached, they will still be able to make deposits, even during the maturity period itself. However, they will no longer be able to make deposits once the maturity period has ended.

- Funding Account: Used to enable the funding of peer-to-peer (P2P) lending.

As of March 15, 2022, Mambu no longer offers the peer-to-peer (P2P) lending feature (also known as loan fractionalization).

Existing customers already using the P2P lending feature, will continue having access to it. However, any new enhancements or changes of this feature have ceased.

If you have any questions, please contact us through Mambu Support.

Product state

Select the Active checkbox under State if you would like to make the product available as soon as it is created.

Product description

The description provides more detailed information about the product and is visible under the product's overview. Other Mambu users can see this information for reference when creating new accounts using this product so you can include any relevant information or refer to any other relevant documents the customers may need.

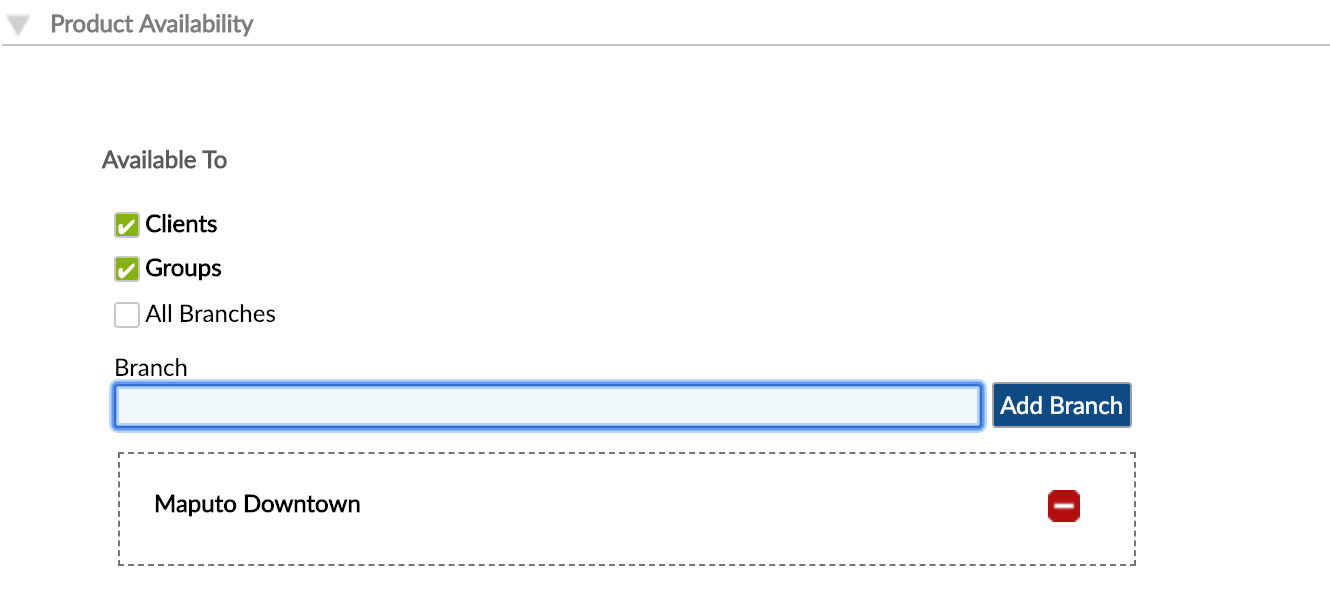

Product availability

Product availability controls:

- whether the product is available to Clients, Groups, or Groups (solidarity), and

- which branches in your organization can offer it.

To specify individual branches, uncheck the box next to All Branches and the Branch field will display. Click in the Branch field to select from a list of branches. To filter results, you may begin typing the name of a branch. To remove a branch from the list, click on the red delete icon to the right of the branch name.

When an account is created for a client, group or branch, Mambu will only allow you to select compatible products from the dropdown list.

New account settings

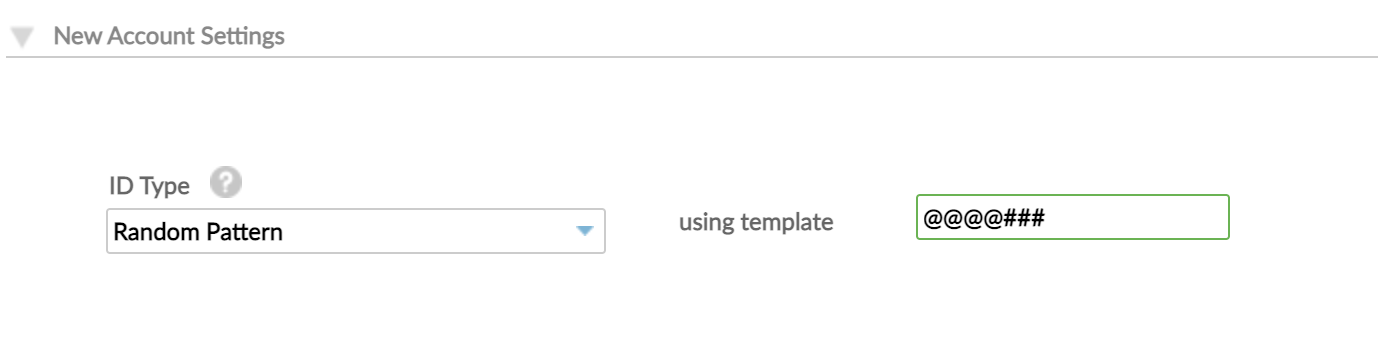

ID settings allows you to customize the IDs generated for all deposit accounts which will later be created under this product. You may either choose a random pattern or incremental numbers for your account IDs.

Random pattern

Input masks or templates are used to configure Mambu to generate alphanumeric IDs or values of a fixed, specified length, which match the specified pattern of letters and numbers.

Templates consist of the characters `#`, `@`, and `$`, where `#` specifies a number, `@` a letter, and `$` a number or a letter, chosen at random. For example, `@#@#$` will configure Mambu to generate five-character values of one letter, one number, one letter, one number, and one character that is either a letter or a number, such as `B8J4P` or `P1F62`.

Only letters and numbers may be used - special characters and punctuation are not supported.

Note that the generated values cannot overflow. When all possible values of the specified length run out, no additional values can be generated. For example, the pattern `##` can only produce 100 unique combinations, 0-99. It is important that you specify templates that will provide as many values as you may need into the future.

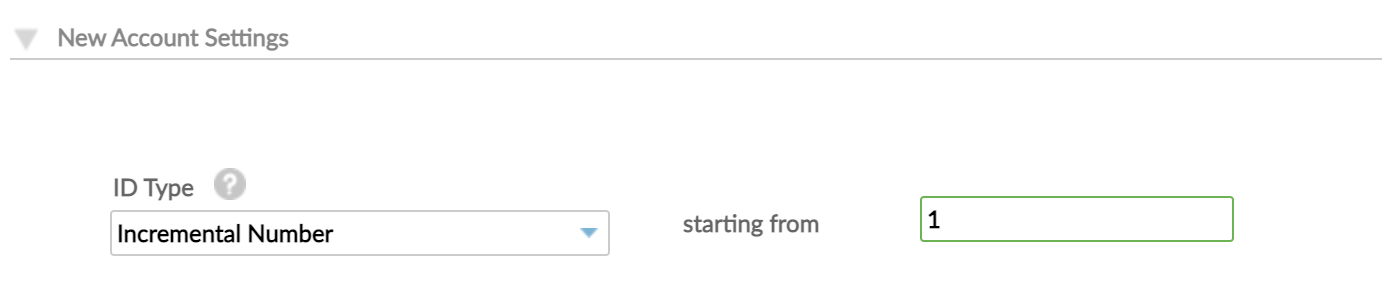

Incremental number

Some organizations may prefer to use incrementing, sequential ID numbers that begin with a specified number.

To configure incremental IDs, select the Incremental Number option from the dropdown and enter the number you want the sequence to start from. Letters may not be used.

Currencies

Mambu allows defining deposit products in various currencies, including cryptocurrencies and performing transactions on the accounts in the selected currency. Your customers have the flexibility to buy, sell and hold cryptocurrencies into any Mambu supported deposit account. You can manage both Fiat and cryptocurrencies, support new currencies as the market shifts, and customise transactions based on your own use cases.

In order to support deposit accounts in different currencies, you must add the currency under Administration > Financial Setup > Currency and set the exchange rate. For more information, go to Currencies.

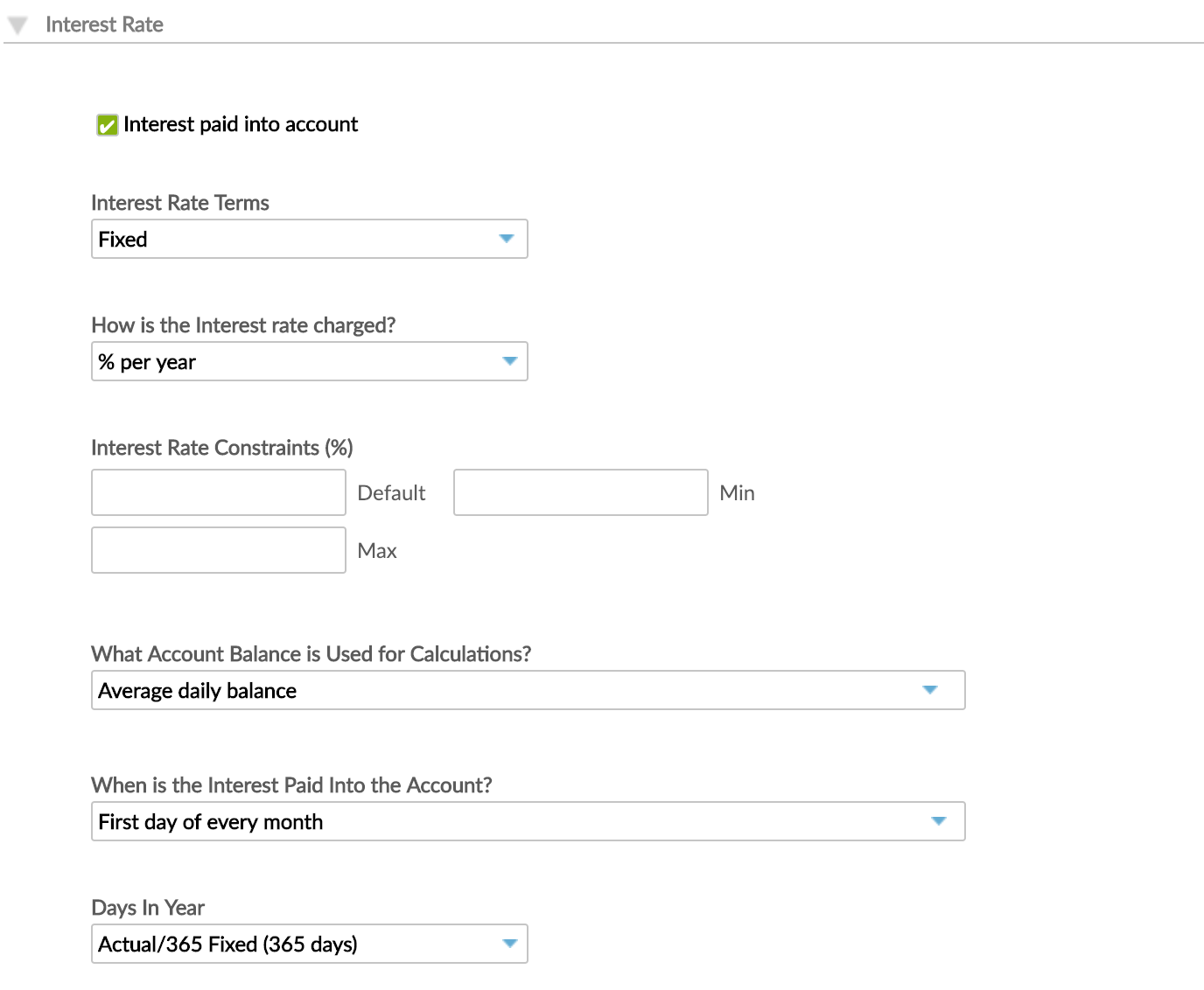

Interest rate

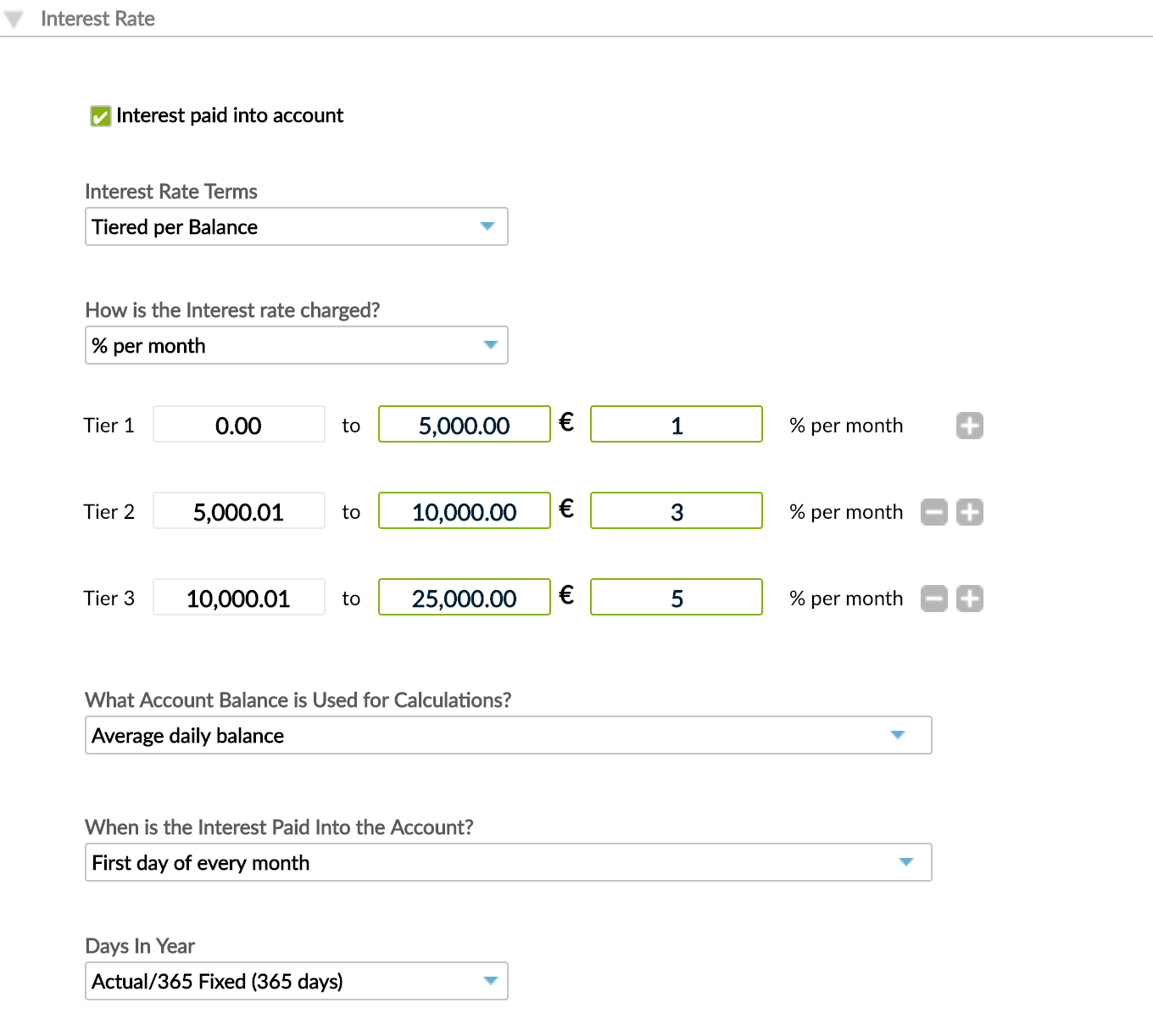

Select the Interest paid into account checkbox if you want your product to pay interest.

Interest rate terms

Mambu supports several types of interest terms:

- Fixed: The interest rate remains the same regardless of the account balance or age. With fixed interest, you can specify the upper and lower limits for the interest rate, as well as a default rate. When creating deposit accounts using this product, you will see the default rate pre-filled into the Interest Rate field; however any number between the minimum and the maximum values can be entered.

- Index: The interest rate is tied to a specific benchmark with rate changes based on the movement of the benchmark. The actual rate offered to the end-customer is a sum of the benchmark or index and a positive interest spread, the spread coming from the Rate sources defined in the Administration tab of the Mambu UI.

- Tiered per Balance: Usually used in savings accounts that pay interest at increasingly higher rates as the account balance increases. Each tier consists of a range of account balances and interest rates earned by customers who fall within that range.

For example:- the first tier may include balances of USD0 to USD5,000 and pay 1% interest.

- the second tier may include balances of USD5,000.01 to USD10,000 and pay 3% interest.

- the third tier may include balances of USD10,000.01 to USD25,000 and pay 5% interest.

Interest is applied on the total deposit balance, according to the respective balance tier. Any amounts exceeding the upper limit of the last tier will still only earn the highest tier amount of interest. So, from our example, an account with a balance of USD50,000 will still earn interest at a rate of 5%.

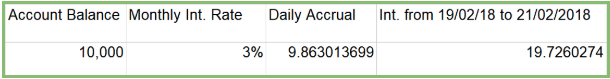

Calculation example:

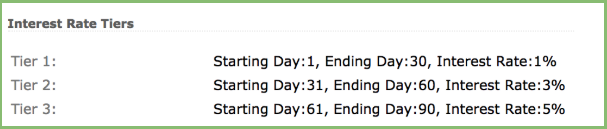

- Tiered per Period: With this option, you can select a time period for each tier in which an associated interest rate percentage will be applied according to the age of the deposit account. When interest is accrued on the account, Mambu will determine the interest rate from the tier that matches the age of the account.

- Tiered per Bands: This option is appropriate for products that pay or charge different interest rates for each tier or for each specific portion of the balance on an account.

Example

The first band may include balances from USD0 to USD25,000 with 3% interest.

The second band may include balances from USD25,000.01 to USD100,000 and charge -1% interest for the balance portion that exceeds USD25,000.

The third band may include balances above USD100,000.01 and charge -3% interest for the balance portion that exceeds USD100,000.

Interest is applied on the deposit balance portion according to the respective tier.

If the account balance is USD150,000:

- the balance portion with 3% interest rate is USD25,000

- the balance portion used for -1% interest calculation is USD75,000

- the balance portion used for -3% interest calculation is USD50,000

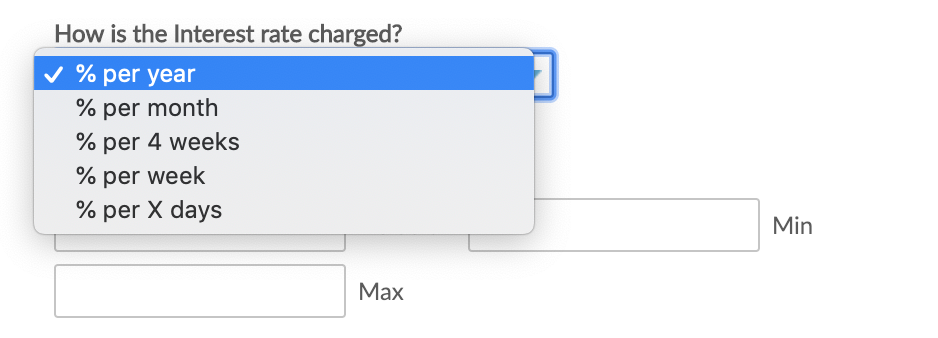

How is the interest rate charged?

Use this setting to specify how interest rate is determined. Available options include: % per year, % per month, % per 4 weeks, % per week, and % per X days.

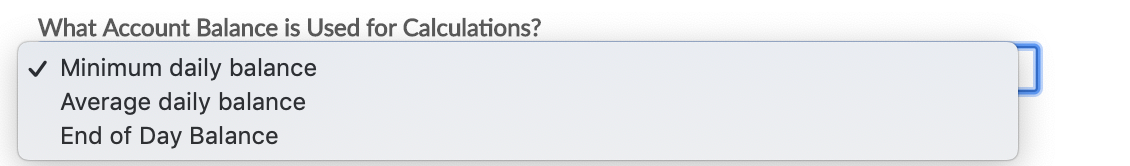

What account balance is used for calculations?

Deposits and withdrawals on an account will cause its balance to go up or down between two postings of interest. As such, you can choose to calculate interest based on the minimum daily balance, average daily balance, or end of day balance.

For more information about how the different options affect the interest calculation, see Interest Calculation Methods in Deposit Accounts.

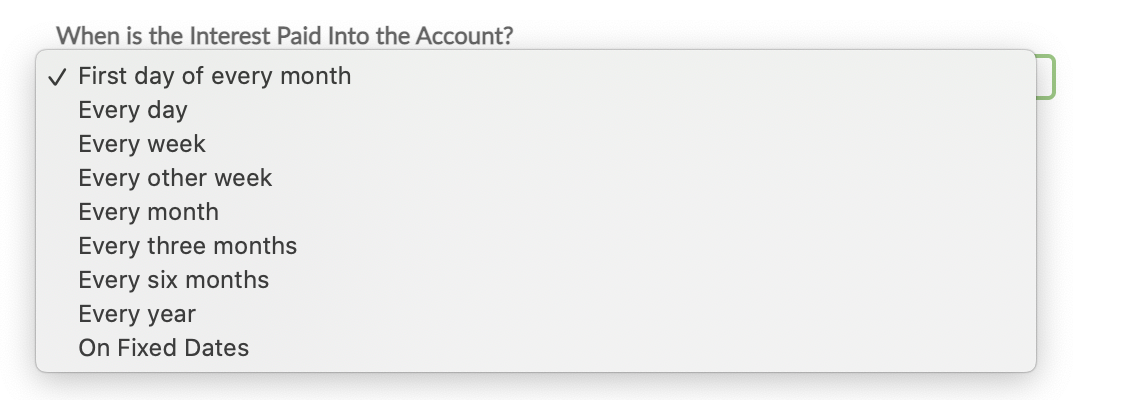

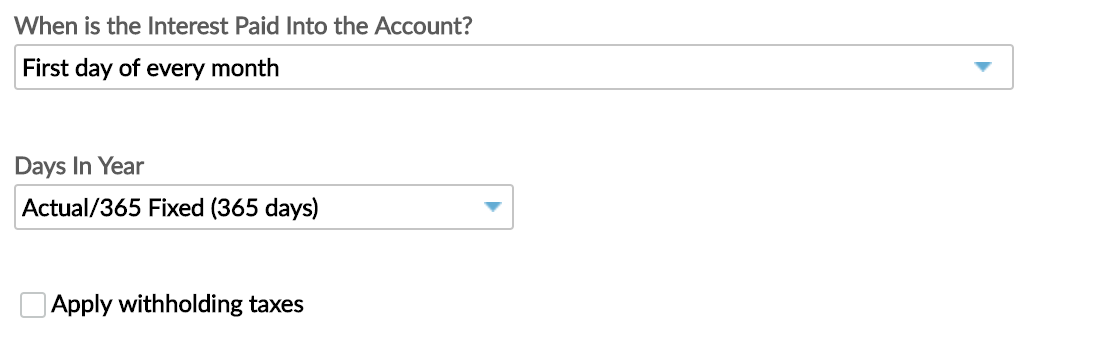

When is the interest paid into the account?

Use this setting to specify how often the interest is posted into the account.

Options include:

- On the first day of every month

- Every day

- Every week

- Every other week

- Every month

- Every three months

- Every six months

- Every year

The every week, every other week, every month, every three months, every six months, and every year options are strictly related to the activation date of the account. An exception to this is when, for example, the account is activated on the 31st of January and you select Every month, then the interest will be paid on the 28th of every coming month.

Interest can also be added on fixed dates. If you choose On Fixed Dates, you must specify the date of the month for each of the 12 months of the year. Click the green plus icon to add another month.

For Fixed deposit and Savings plan product types, you can choose another option, which is also the default option, On account maturity.

With the When is the Interest Paid Into the Account? setting, you also define when you wish to apply negative interest on Overdraft accounts.

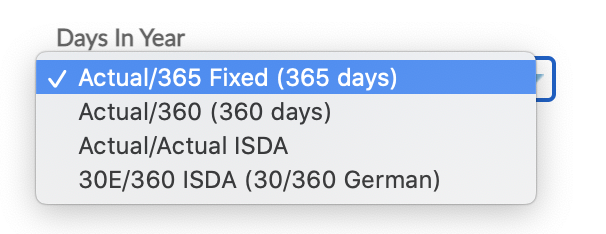

Days in year

Depending on your internal practices, you may calculate interest over 365 or 360 days in a year. Given that interest accrues daily during a deposit's lifetime, the interest due for any deposit depends on the number of days in the month and is determined by the difference in the number of days between the last deposit and the current one.

In a 360-day year, every month is considered as having 30 days. The 365 days option takes the actual number of days in each month into account.

Withholding taxes

It is a regulatory requirement in many countries that organizations offering deposit accounts have to pay taxes on the interest generated by those accounts and paid to clients. These are generally called withholding taxes because they are deducted from the interest paid to the client.

To enable withholding taxes, select the Apply withholding taxes checkbox under the Interest Rate section.

Apply withholding taxes can be enabled only when:

- The Interest paid into account checkbox is selected.

- At least one withholding tax rate source is defined under Administration > Rates. For more information, see Customizing Index Interest Rates & Tax Rates.

- The interest calculation method with positive interest rate is selected.

Once the withholding taxes option is enabled, the actual applicable tax will have to be specified at account opening. For more information, see Creating a Deposit Account.

After interest is applied on the account, Mambu will post a withholding tax transaction on the account, that will subtract the tax percentage of the applied interest from the account balance.

This option can be disabled even if there are accounts opened in the product. If taxes are disabled, new accounts won't have applicable taxes, but the old accounts will retain them.

If the product has accounting enabled, then a "Taxes Payable" liability GL account has to be linked and will be used for booking the amount of taxes withheld and for the government.

The tax percent, source name, and amount are available as placeholders in your contracts, receipts, and templates.

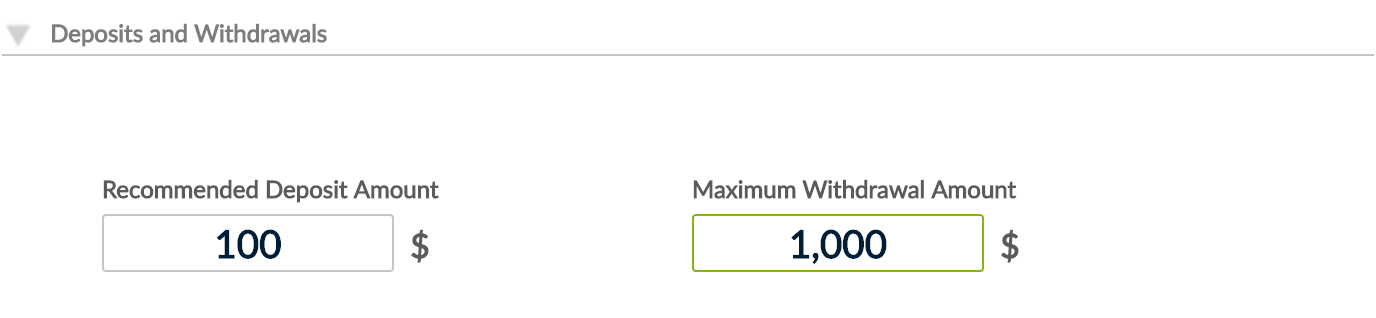

Deposits and withdrawals

When you make a deposit, you add money to an account, and when you make a withdrawal, you subtract money from an account.

Recommended deposit amount

In Fixed Deposits and Savings Plans products, you can determine if there should be a recommended deposit. The amount you enter here only serves as a guideline and not as a constraint. The client will still be able to make deposits that fall under or above this value.

You can also define a maximum deposit balance at the account level.

Maximum withdrawal amount

You can determines an exact value beyond which the client can't withdraw money in a single transaction.

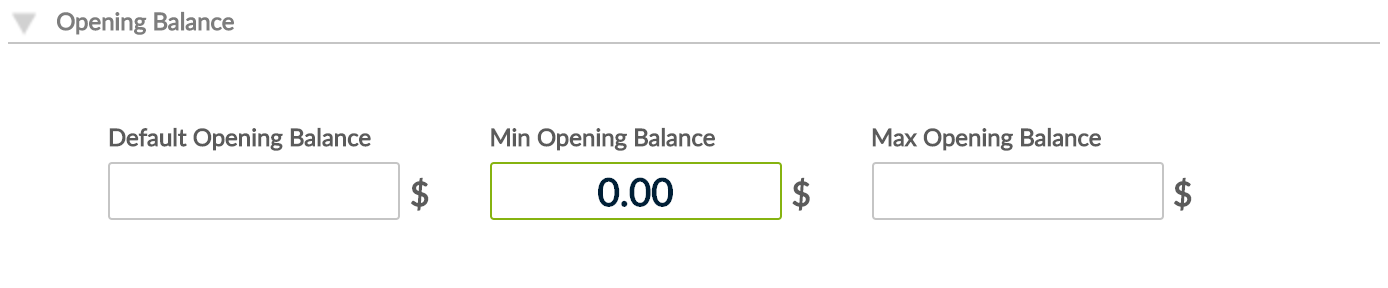

Opening balance

In Fixed Deposit products, you can determine a minimum amount that clients must deposit before the maturity period begins.

This is a mandatory field, but you can always enter 0, in which case the maturity period can begin with the first deposit transaction.

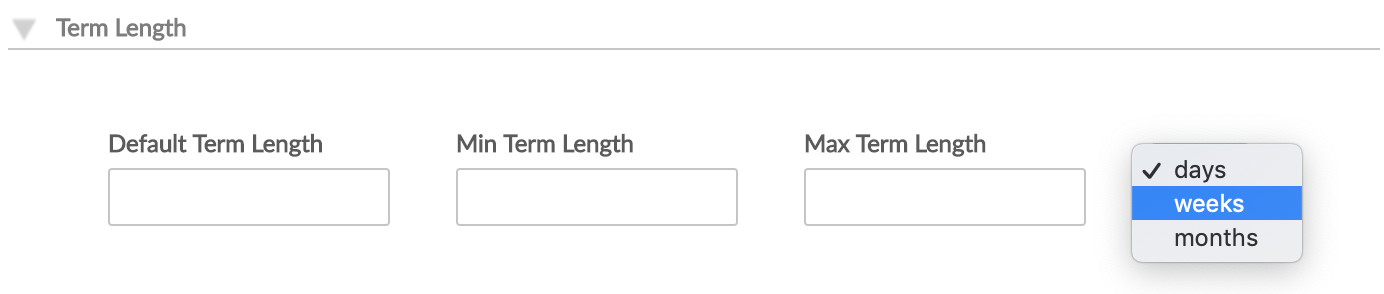

Term length

In Fixed Deposits and Savings Plans products, you can define the period of time between the account opening and the maturity date, in which the client cannot withdraw money.

To define the term length, enter the default, minimum and maximum values, and choose the time unit from the dropdown: days, weeks, or months.

During the term length you cannot make any withdrawals unless you are an administrator or you have the Make early withdrawal permission.

Internal controls

The internal controls section allows you to define a few internal controls for the deposit product.

Automatically setting accounts as Dormant

You may choose to automatically set accounts as Dormant after a number of days, where there has been no financial activity on that account other than posting of interest. Funds can be claimed by the owner or beneficiary at any time even if the account is in a Dormant state.

To enable this option, select the Automatically set accounts as Dormant checkbox.

One advantage of using this option is that it reduces the risk of incorrect reports and it helps you select the clients that are active in the system but with no activity on their accounts and then decide a course of action.

This option is available for all types of deposit products. However, the system will not set an account to Dormant if it has a maturity date (Fixed deposits and Savings Plan products).

Allowing accounts to be used for Offset

You may choose to allow accounts created under this product to be used for Offset purposes. This way, deposit accounts are linked to loan accounts, similar to settlement accounts. The balance on the Offset deposit account is offset against the outstanding principal of the loan for interest calculation purposes. When calculating interest for a Dynamic Term loan account with the Offset deposit account enabled, Mambu will deduct the balance on the offset deposit account from the outstanding principal of the loan account before multiplying by the interest rate, instead of multiplying the interest rate directly with the outstanding principal balance of the loan. For more information, see Redraw and Offset Settings.

To enable this option select, the Allow accounts to be used for Offset checkbox.

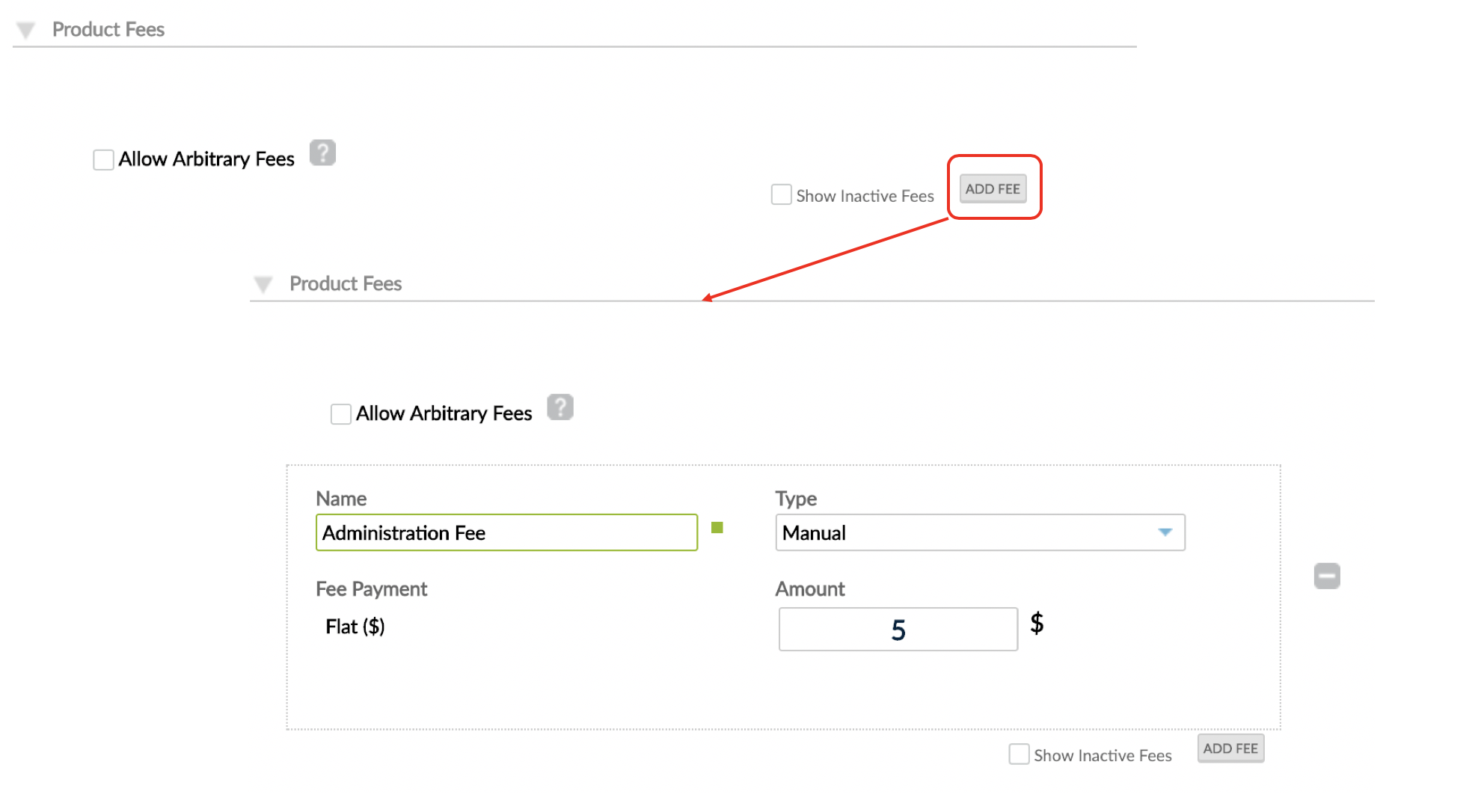

Product fees

You can use Mambu Functions to create custom fees to bind to your deposit products. Mambu Functions allow you to inject custom code and extend the Mambu banking platform. For more information on creating and deploying Functions, see Building and Deploying Mambu Functions.

For more information on setting up desposit fees, see Deposit fees setup.

Mambu supports three types of fees you can set up when creating a deposit product and later apply to deposit accounts.

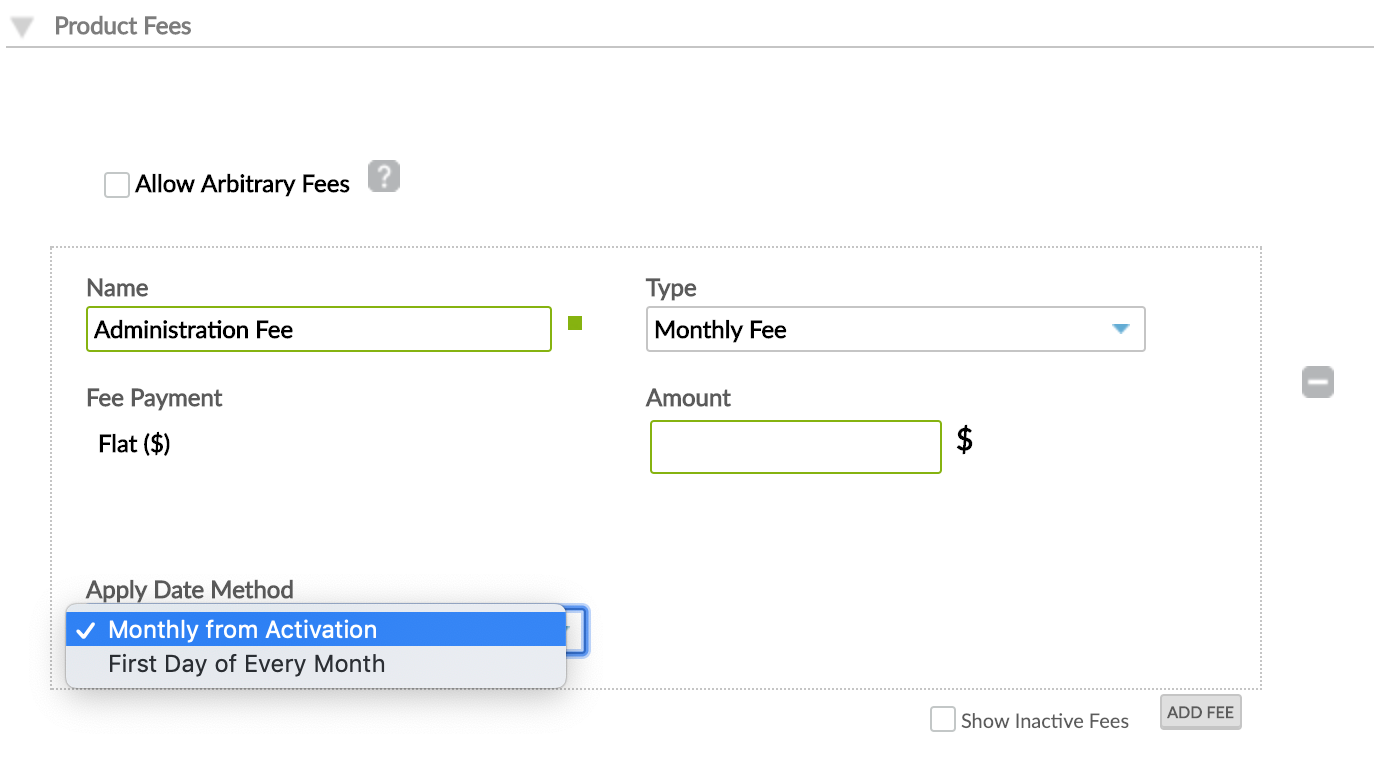

Arbitrary fees

These are fees which can be applied manually to the accounts at any point during its lifetime and with any given amount. To activate arbitrary fees, select the Allow Arbitrary Fees checkbox.

Arbitrary fees can be applied on an ad hoc basis. However, if you apply these kind of fees, you will not be able to separate accounting or reporting based on the fee type. Moreover when going through an audit retrieving the reason for fee application will be more difficult. We strongly recommend creating and applying manual fees for each scenario instead.

Manual fees

These are fees, for which you already know the amount you want to apply. To set up a manual fee, select Add Fee > enter the name and the amount of the fee.

Monthly fees

These are fees that are automatically applied to the accounts after being set up in the deposit product.

To define monthly fees:

- In the Product Fees section of the Creating a New Deposit Product form, on the bottom-right corner, select Add Fee.

- Under Type, choose Monthly Fee.

- Enter the amount.

- Choose the method for calculating the day when the fee will be applied. See an example in the following table.

- Save.

| Account Activation Date | Monthly from Activation | First Day of Every Month |

|---|---|---|

| 1st October | First fee →1st November Fees applied 1st of each subsequent month | First fee →1st November Fees applied 1st of each subsequent month |

| 16th October | First fee →16th November Fees applied 16th of each subsequent month | First fee →1st November Fees applied 1st of each subsequent month |

| 31st October | First fee →30th November Fees applied last day of each subsequent month (for February, 28th or 29th) | First fee →1st November Fees applied 1st of each subsequent month |

For more information about how to apply or adjust fees, see Managing Fees in Deposit Accounts.

:::

Accounting rules

If you want to link your deposit products to accounting, you must Enable accounting and then select the appropriate GL account for each action.

Custom fields

If you have configured custom field definitions for your deposit products, you'll have them listed and grouped by custom field set at the very end of the Creating a new deposit form. Once the product is created, the custom field values will show up at the bottom of the deposit product overview page.

For more information, see Custom Fields.