- 16 May 2023

- 8 Minutes To Read

- Print

- DarkLight

- PDF

Processing Loan Repayments

- Updated On 16 May 2023

- 8 Minutes To Read

- Print

- DarkLight

- PDF

You can process single, partial, custom or bulk repayments. These may be entered in the present or backdated.

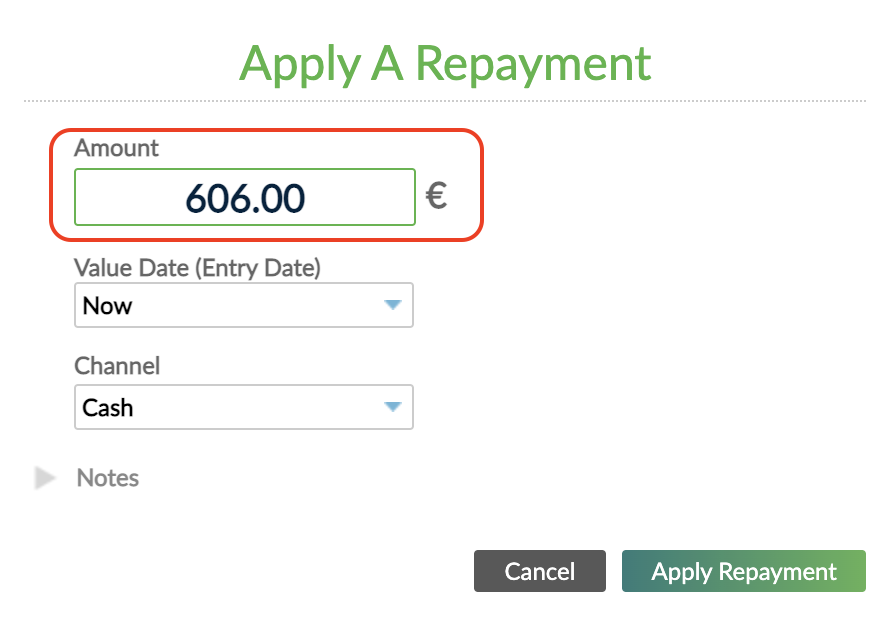

Enter a single repayment

To enter a single repayment to a client or group's loan account:

- Open the client's profile.

- Select the appropriate loan account.

- On the right-hand side of the screen, select Enter Repayment.

- In the Apply a Repayment dialog, enter the amount, the entry date, the transaction channel (by using the Channel dropdown), and some notes about the repayment. If a repayment is due, the Amount field is automatically populated with the total due amount, which includes principal, interest, fees, and/or penalties due balances.

- Select Apply Repayment - the repayment will be done based on the allocation order you set up when creating the loan product.

Interest accrued (which is only a parameter at account level, not a balance) will not be paid or displayed in the total due balance if it's not applied. If interest accrued is applied, you'll be able to see an interest balance for it.

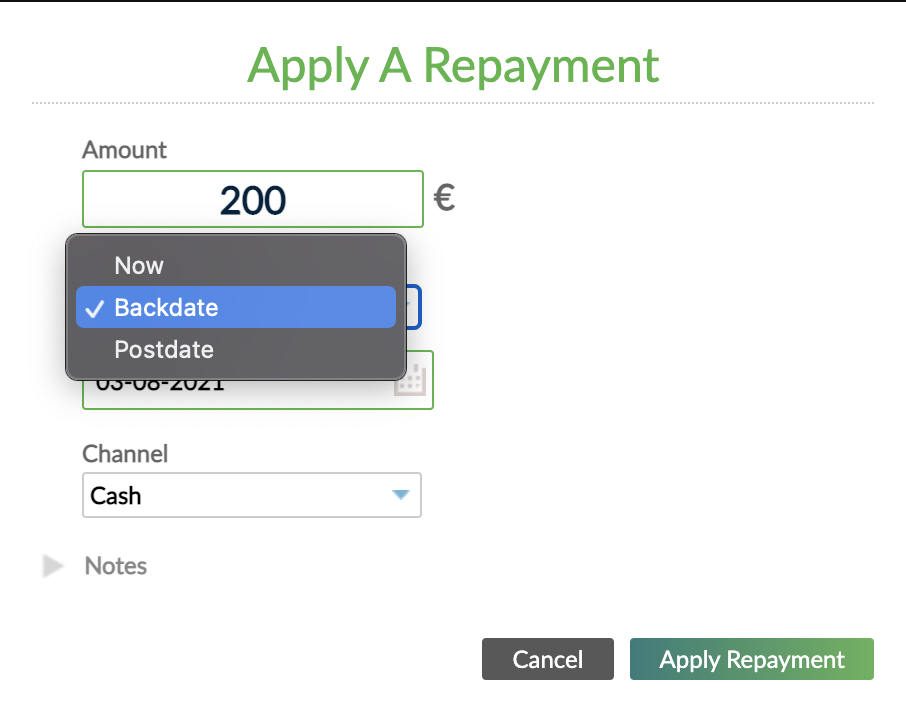

Backdate repayments

By default, when entering a repayment the transaction date will be today. You can choose to backdate a repayment, but you need to make sure that there are no repayments already entered after this date.

To backdate a repayment:

- Open the client's profile in the Mambu UI.

- Select the appropriate loan account.

- On the right-hand side of the screen, select Enter Repayment.

- In the Apply a Repayment dialog, enter the amount.

- Under Entry Date, select Backdate and enter a date in the past.

- Select Apply Repayment.

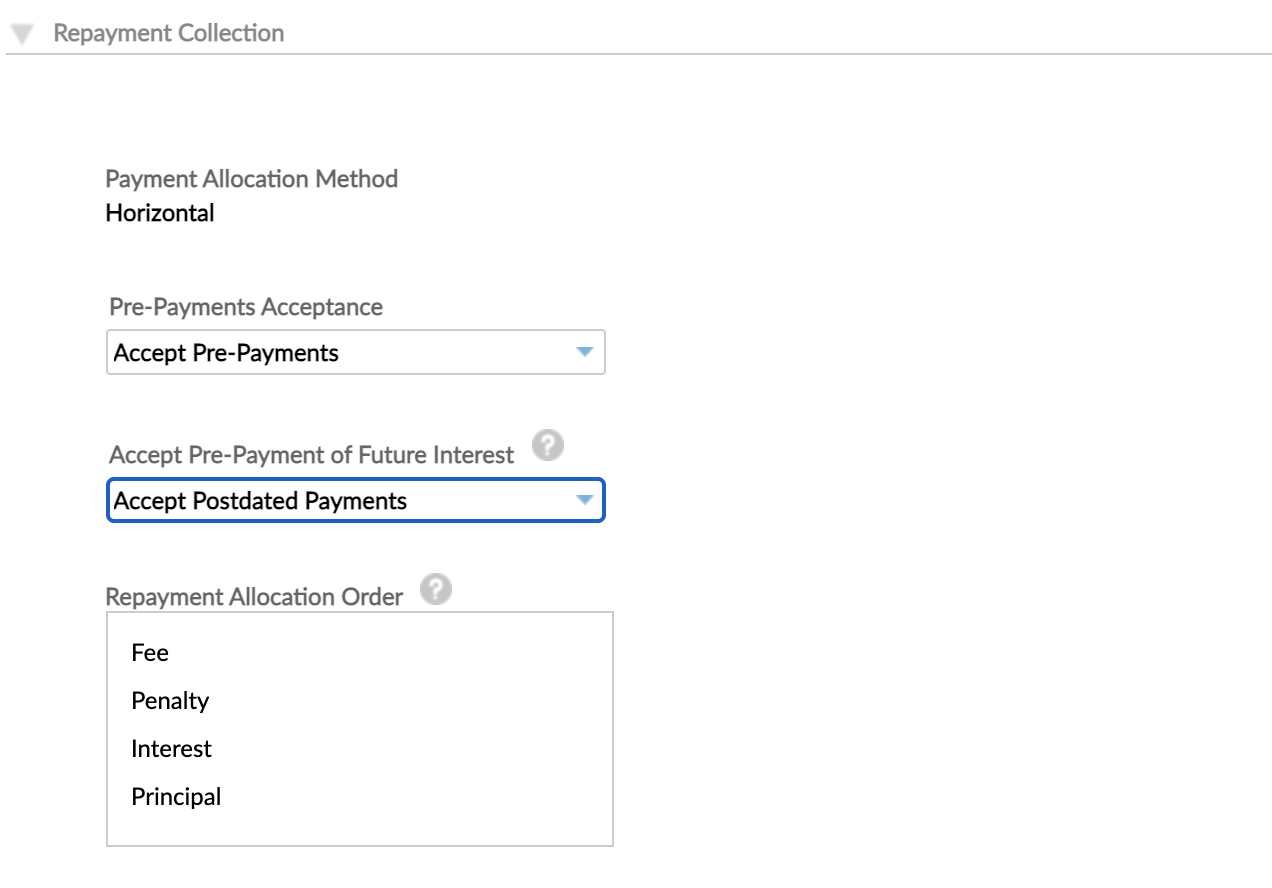

Future-dated repayments

Loan accounts using the Fixed Flat method do not depend on time for interest calculation and for that reason repayments can be entered with a future date, if necessary. To be able to accept postdated payments, you must specify this when setting up new loan products, in the Repayment Collection section.

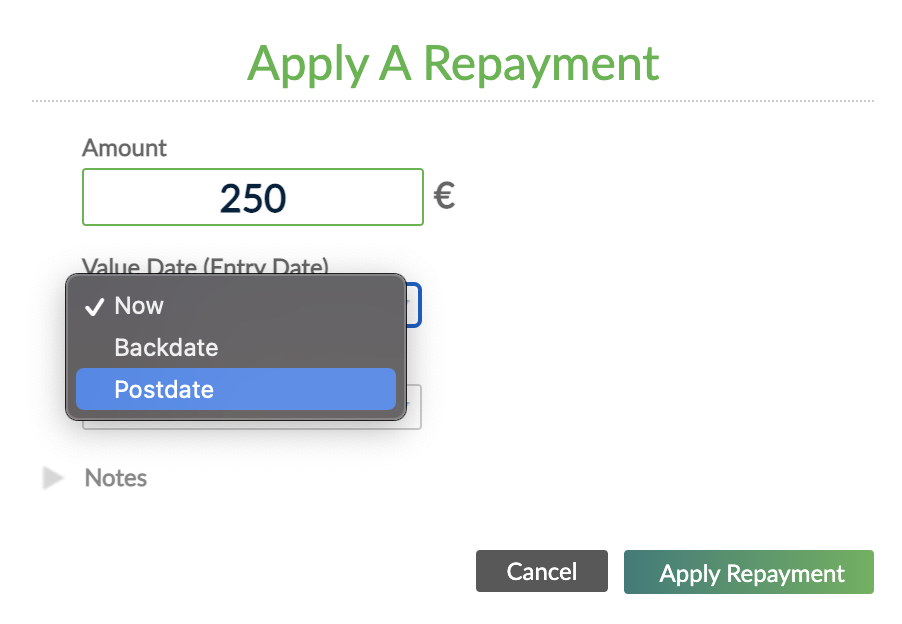

To enter a repayment in the future:

- Open the client's profile in the Mambu UI.

- Select the appropriate loan account.

- On the right-hand side of the screen, select Enter Repayment.

- In the Apply a Repayment dialog, enter the amount.

- Under Value Date (Entry Date), select Postdate.

- Select Apply repayment.

Mambu will apply the repayment according to the schedule, on the next pending installment or installments due dates.

Example

If we have a new loan, with no repayments entered, on which a USD300 payment is postdated. Mambu will split the USD300 according to the schedule and record the transactions on the installment due dates.

Enter a custom repayment

In order to post a custom repayment, you need the Perform Repayments With Custom Amounts Allocation permission.

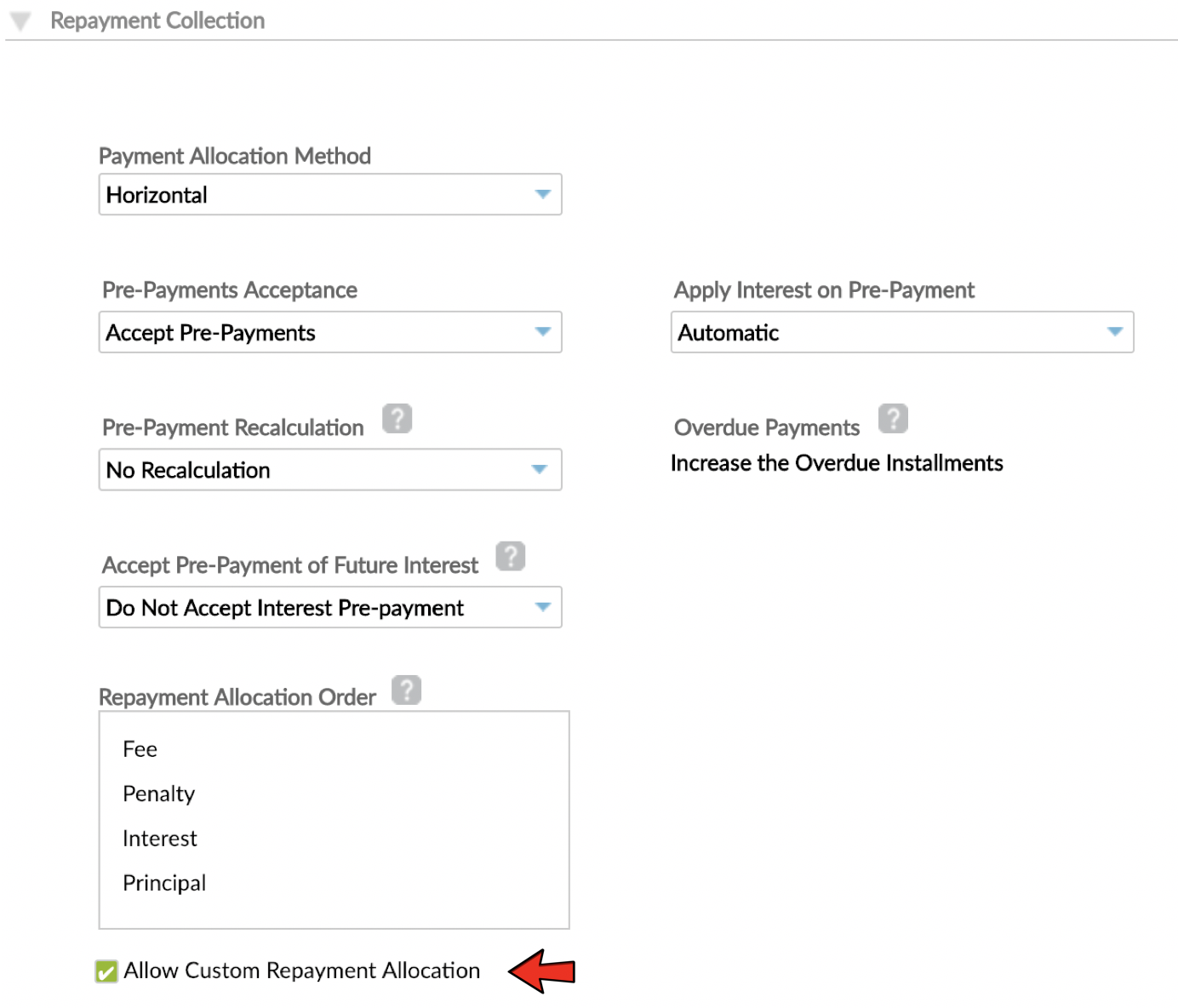

At a Dynamic Term product level, in the Repayments Collection section, select Allow Custom Repayment Allocation.

Once this option is enabled, you can allocate the repayment amount to principal, interest, fee name or fee type, or penalty balance.

When you allocate a repayment to fees via API 2.0, you can choose to which fee type or fee name you want to alocate it. When you allocate a repayment to fees via the UI, you can choose to which fee name you want to alocate it.

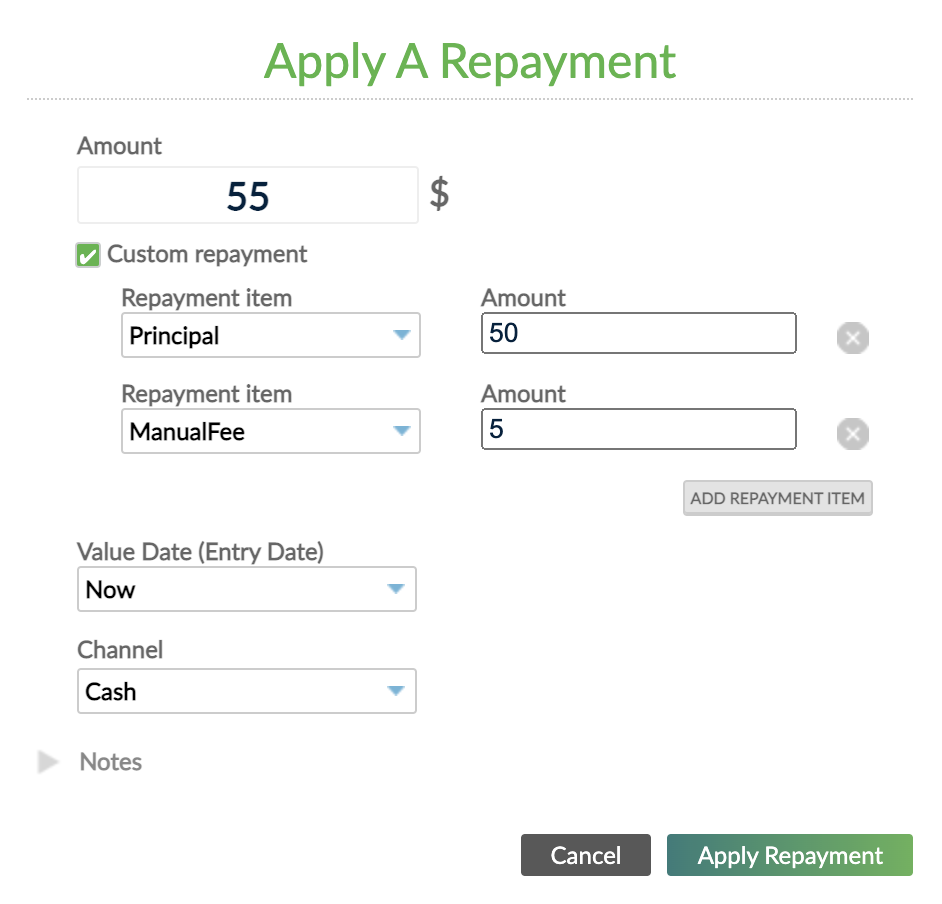

To enter a custom repayment in the UI:

- Open the loan account.

- On the right-hand side of the screen, select Enter Repayment.

- In the Apply a repayment dialog, select the Custom repayment checkbox.

- Allocate the repayment according to the client's preference.

- Under Entry Date, select the date of the repayment.

- Using the Channel dropdown, select the transaction channel used to enter the repayment.

- Optional: Add any notes related to the repayment.

- Select Apply Repayment.

Below you can find an example of how a custom repayment can be allocated according to the client's preference via API 2.0:

- Principal balance: USD1000

- Fee balance: USD100

- Manual fees: USD30

- Upfront fees: USD70

- Interest balance: USD10

When we enter a repayment of USD200, we can choose to allocate the repayment amount towards Upfront Fee, Interest and Principal:

{"customPaymentAmountType":"UPFRONT_DISBURSEMENT_FEE",

"amount":"70"},

{"customPaymentAmountType":"INTEREST",

"amount":"10"},

{"customPaymentAmountType":"PRINCIPAL",

"amount":"120"},

After the repayment is posted, the remaining amounts will be:

- Principal balance: USD880

- Fees balance: USD30

- Manual fees: USD30

- Upfront fees: USD0

- Interest balance: USD0

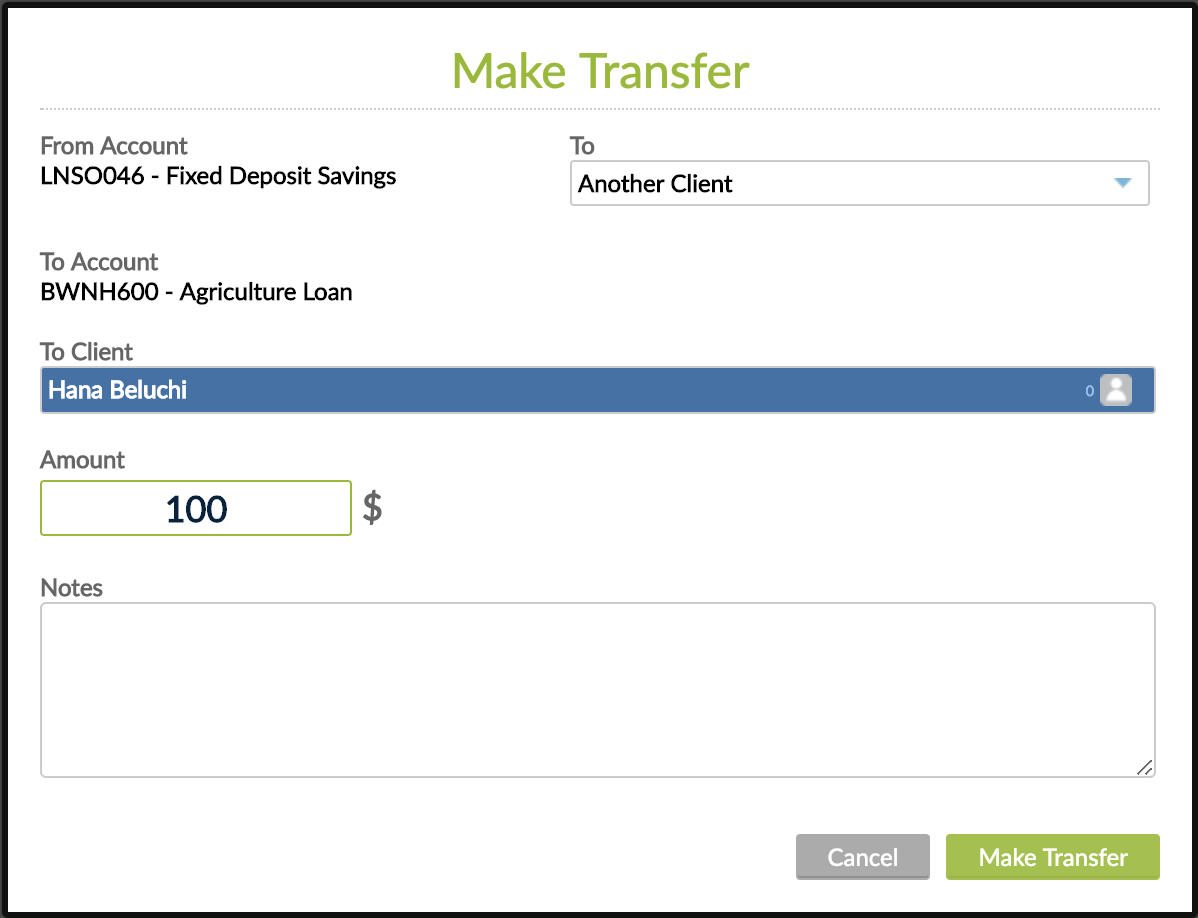

Enter a repayment from a deposit account

A repayment can be entered from a deposit account directly to the loan account.

- Open the deposit account.

- Select Transfer.

- In the Make Transfer dialog, under To Client, select the target loan account from the dropdown.

- Enter the amount you wish to tranfer.

- Optional: Add any notes related to the transfer.

- Select Make Transfer.

This can be done between different clients, so client A could make a repayment to client B.

In order to reverse the transaction, the original transfer must be reversed from the deposit account and with it, both transactions will be reversed.

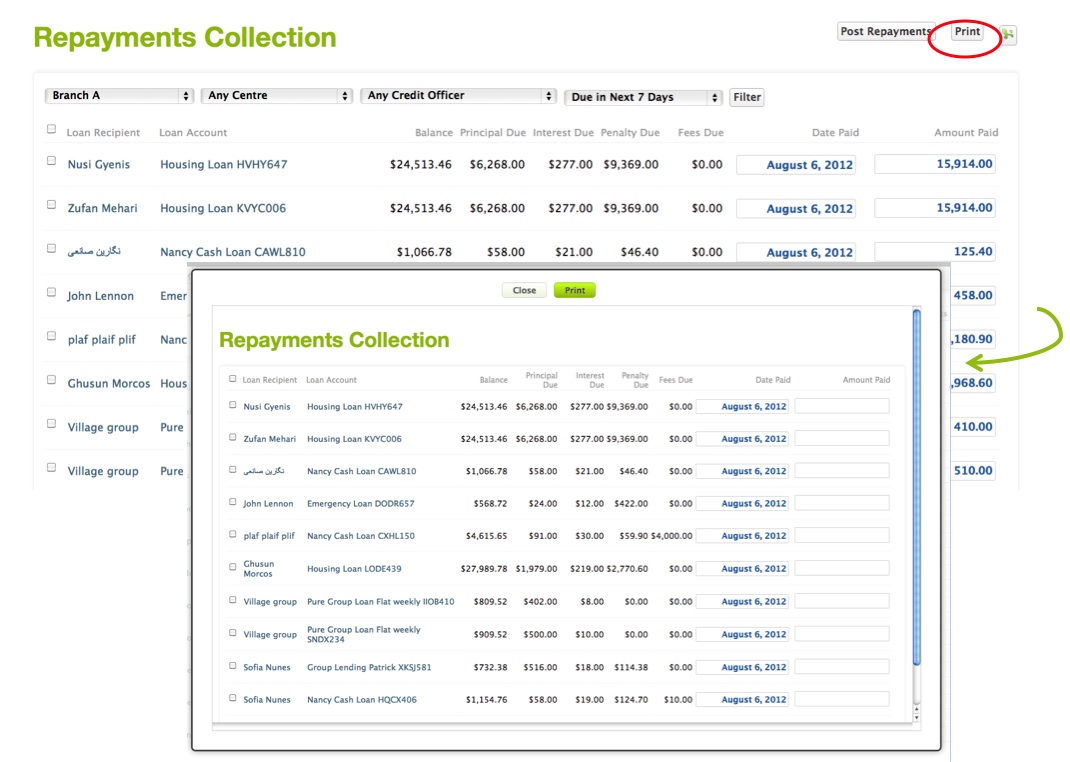

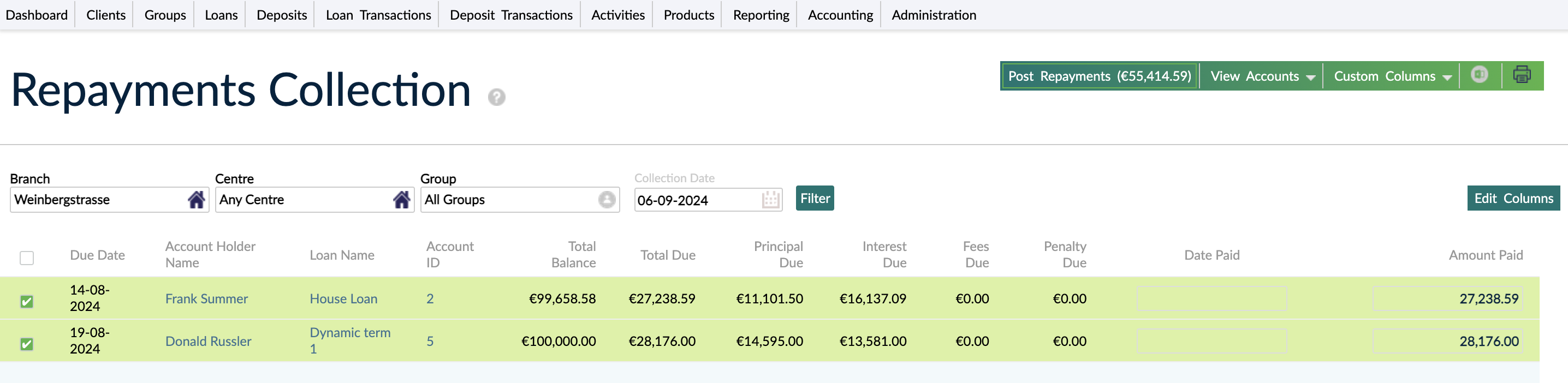

Bulk repayments collection

You can generate loan repayments in bulk—for one or more accounts, for one date or a range of dates—and then you can print, export or process these payments.

When a bulk repayment is processed, a process is sent to the database and it is marked as Queued. In the UI a progress bar with 0% is displayed to show that the process is set to begin. When a worker is available the process will move to an In Progress state in the database. In the UI, the progress bar will show the progress of the repayments. After the process is done, it will be marked as Completed in the database and the progress bar will disappear.

You cannot do two bulk payments at the same time. Any attempt to do this will result in a warning message: “Another process is in progress”.

Filtering repayments

To filter the accounts or the repayments that you want to process or print, go to Loan Transactions > Repayments Collection in the main menu. Click on the dropdown menus to filter the repayments per branch, centre, credit officer, group, and dates. Then click on Filter.

View repayments vs. View accounts

If you select the View Repayments option, you will see all the repayments (installments) that are due within the selected dates. For example, you might see more than one repayment due for the same account if the range is two weeks and the account has weekly payments. The amount displayed in each row will be the repayment amount expected as per the schedule. The Date Paid and Amount Paid fields will be populated with default values from the repayment schedules of those accounts, assuming that the client paid the exact amount due on the due date.

When selecting the View Accounts option, you will see the total amount due for each account as of the specified date or a sum of all amounts due up to that date, if the client missed several installments. When selecting this view you can only select a single date, not a date range.

Posting a batch of repayments

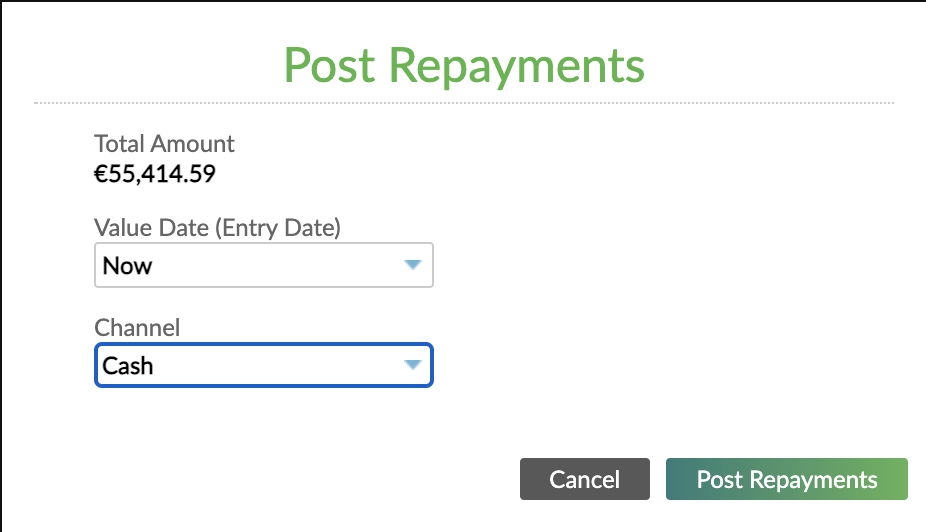

To enter the repayments, select the correspondent check boxes for each repayment or account, select Post Repayments in the new dialog, add the required details and then select Post Repayments.

When posting the repayments you can specify the transaction channel to be used (by using the Channel dropdown) for all the repayments in the batch, along with any transaction details such as a check or receipt number and you can choose to backdate the transaction, if needed. All of these settings will be applied to all the payments in that batch.

Customizing columns

Just as in custom views, you can customize which columns you want to see in the report. If you include any columns for transaction channel details, you can use them to enter a specific transaction channel info for each repayment.

Printing repayment collection sheets

The repayments collection tool can also be used to display and keep track of repayments due within a specific date. The list can then be printed and given to field staff who collect repayments directly from clients.

To print a list of repayments due, use the filters to display the list you want to print on the right-hand side of the screen, and select Print.

Partial repayments

When a client does not pay the total amount due for a specific repayment, Mambu automatically sets a status of Partially Paid to that repayment. The amount paid will then be allocated according to the settings you defined in the Lending Parameters. So, the order you determined in that section will define your organization's priority in terms of what needs to be paid first, principal, interest, fees, or penalties.

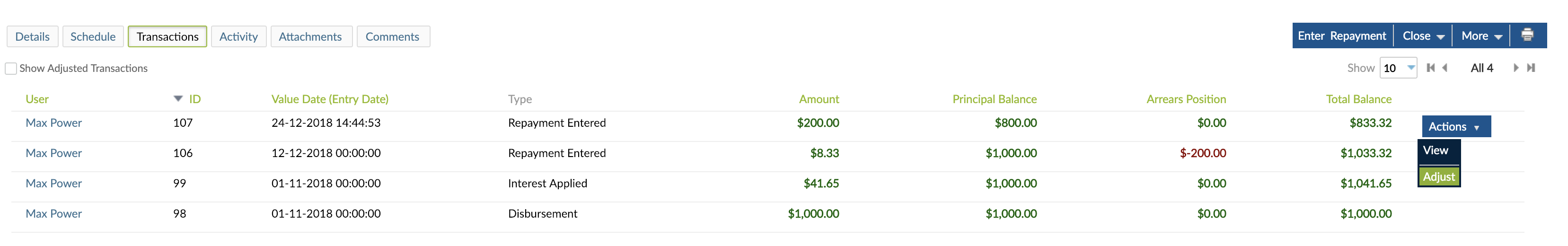

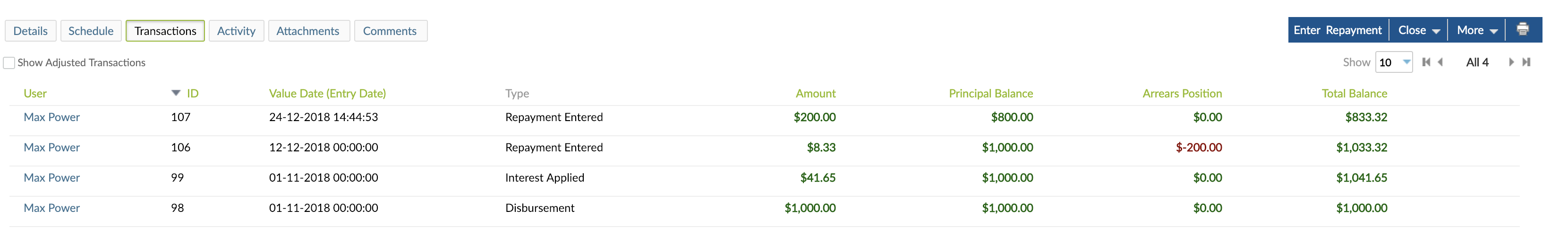

Revert last repayment

To revert the last repayment entered into an account:

- Open the loan account.

- Go to the Transactions tab.

- Find the last repayment.

- On the right-hand side of the row, select Actions > Adjust.

- Enter the reason for the reversal.

- Select Reverse Repayment.